fremont ca sales tax calculator

For a list of your current and historical rates go to the California City. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local.

8 25 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

Method to calculate elk grove sales tax in 2021.

. Interactive Tax Map Unlimited Use. The minimum combined 2022 sales tax rate for Fremont California is. Fremont County in Iowa has a tax rate of 7 for 2022 this includes the Iowa Sales Tax Rate of 6 and Local Sales Tax Rates in Fremont County totaling 1.

California has a 6 statewide sales tax rate but also. Usually the vendor collects the sales tax from the consumer as the consumer makes a. Fremont California and San Jose California.

The California sales tax rate is currently. Local tax rates in California range from. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Fremont CA.

Ad Lookup Sales Tax Rates For Free. You can find more tax rates and. The current total local sales tax rate in fremont ne is 7000the december 2020 total local sales tax rate was also 7000.

Monrovia California and Fremont California. Fremont ne sales tax rate. Calculate a simple single sales tax and a total based on the entered tax percentage.

California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local. The 1025 sales tax rate in Fremont consists of 6 California state sales tax 025 Alameda County sales tax and 4 Special tax.

There is no applicable city tax. 2022 Cost of Living Calculator for Taxes. The December 2020 total local sales tax rate was 9250.

The Fremont County Iowa sales tax is 700 consisting of 600 Iowa state sales tax and 100 Fremont County local sales taxesThe local sales tax consists of a 100 county sales tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The december 2020 total.

The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725. The Fremont Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Fremont local sales taxesThe local sales tax consists of a 150 city sales tax. This is the total of state county and city sales tax rates.

The base state sales tax rate in California is 6. CA Sales Tax Rate. 39812 Mission Blvd Suite 206 Fremont Ca 94539 Phone 59-510-413-7046.

The sales tax can be as high as 105 percent as of 2021 with the recent changes to the tax law. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The current total local sales tax rate in Fremont CA is 10250.

2022 Cost of Living Calculator for Taxes. Method to calculate Fremont sales tax in 2021. List of sales tax rates in california.

You can print a 1025. Fremont in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Fremont totaling 15. You can find more tax rates and.

For State Use and Local Taxes use State and Local Sales Tax Calculator. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

How To Use A California Car Sales Tax Calculator

Why Households Need 300 000 To Live A Middle Class Lifestyle

Nebraska Sales Tax Small Business Guide Truic

Calculate Import Duties Taxes To United States Easyship

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

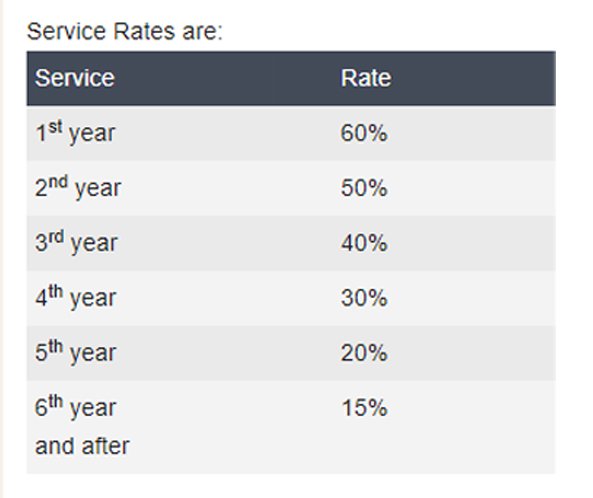

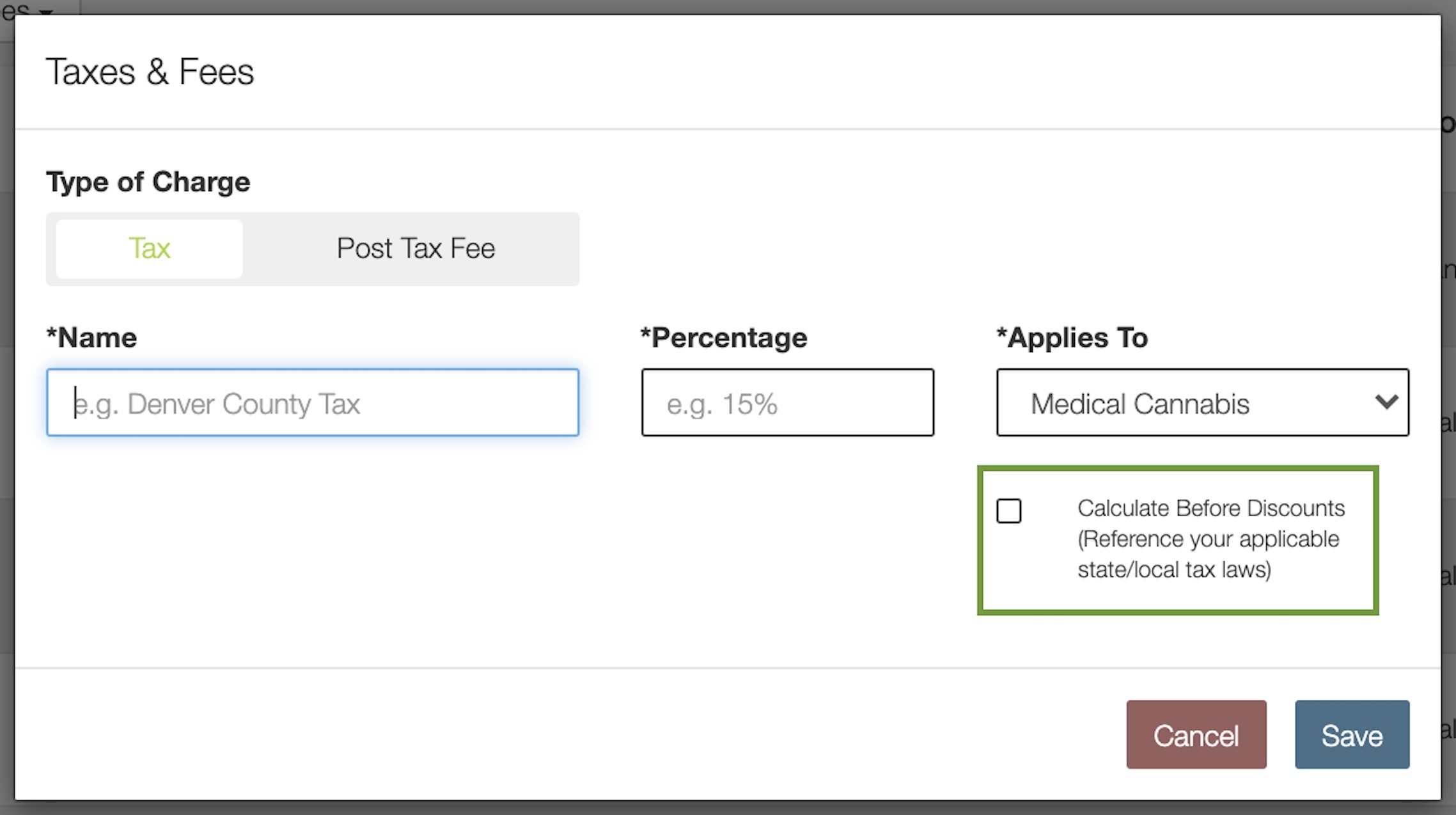

How To Calculate Cannabis Taxes At Your Dispensary

How Much Is A 160 000 Year Salary After Taxes In California Quora

How To Calculate Cannabis Taxes At Your Dispensary

Calculate Import Duties Taxes To United States Easyship

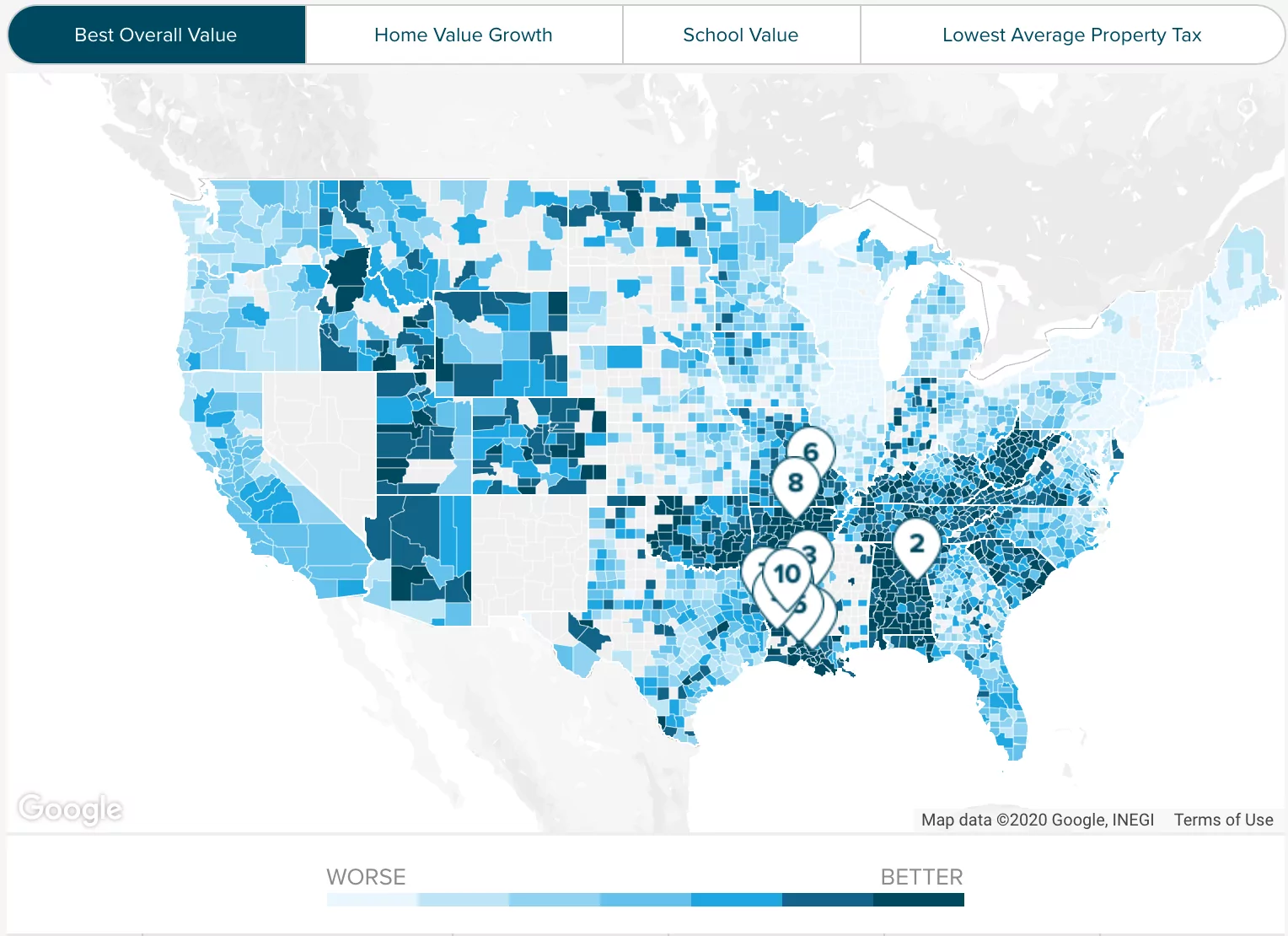

Understanding California S Property Taxes

How To Calculate Cannabis Taxes At Your Dispensary

California Sales Tax Rates By City County 2022

California Paycheck Calculator Smartasset

Why Households Need 300 000 To Live A Middle Class Lifestyle

Food And Sales Tax 2020 In California Heather

How To Calculate Cannabis Taxes At Your Dispensary

California Vehicle Sales Tax Fees Calculator